Not known Facts About Hard Money Atlanta

Wiki Article

The Hard Money Atlanta Diaries

Table of Contents9 Simple Techniques For Hard Money AtlantaUnknown Facts About Hard Money AtlantaHow Hard Money Atlanta can Save You Time, Stress, and Money.8 Easy Facts About Hard Money Atlanta ShownThings about Hard Money Atlanta

One of the largest distinctions in between a tough money lending and also a standard lending is that difficult cash loan providers use the worth of the property versus the customer's creditworthiness to identify the finance. One of the biggest advantages of a difficult money finance is there are less restrictions with difficult cash finances when.comparing them to traditional loansConventional Fundings from financial institutions and also typical lending institutions usually take up to 60 days to release, while hard money finances can often fund in a week.

Time is cash in genuine estate as well as time is on your side with difficult money. Tough cash lendings also supply tremendous take advantage of for fix and turn and acquire as well as hold capitalists. The financier can enter a property job without putting their own cash at danger as well as remaining liquid. This is a big factor actual estate capitalists choose difficult cash lenders in Florida.

Some Ideas on Hard Money Atlanta You Need To Know

This device numbers regular monthly repayments on a tough money loan, supplying settlement amounts for P&I, Interest-Only as well as Balloon payments together with giving a regular monthly amortization schedule. This calculator automatically figures the balloon repayment based on the gotten in car loan amortization duration. If you make interest-only payments then your monthly settlements will certainly be the interest-only settlement amount listed below with the balloon payment being the original amount borrowed.

While financial institutions and also credit rating unions supply commercial loans, not every person can access them. Conventional commercial home loans enforce rigorous underwriting procedures that take a very long time to obtain approved (3 months or even more). They need high credit ratings as well as evidence that your business has adequate capital to pay off the home mortgage.

If you can not secure a traditional business financing, you can turn to difficult money lending institutions. In this post, we'll talk about difficult cash financing demands, its repayment framework, and prices.

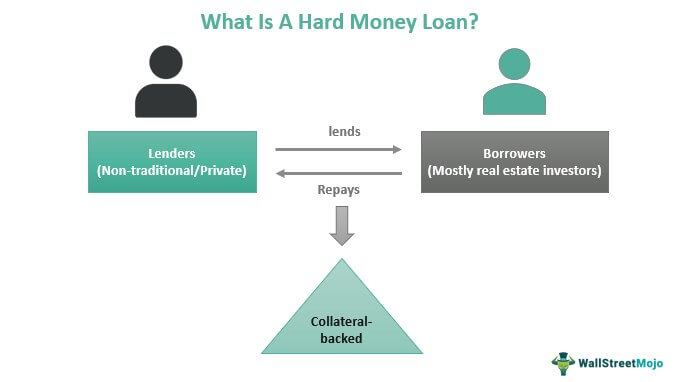

What are Hard Money Fundings? A hard money loan is a kind of commercial home loan supplied by an independent financier, such as a firm or person. It is normally considered a short-term of 12 months to 3 years. Unlike commercial financings from banks, tough cash loans are based on residential or commercial property being made use of as security instead than the debtor's creditworthiness.

Some Of Hard Money Atlanta

This is typically considered the last resource if you are unqualified for conventional commercial financing. Economists state hard describes the nature of the lending, which is hard to finance by traditional criteria. Others state it refers click for more to the collateral of the car loan being a hard property, which is the genuine estate home safeguarding the financing.This tool numbers regular monthly payments on a difficult money car loan, using repayment quantities for P&I, Interest-Only as well as Balloon settlements together with supplying a regular monthly amortization schedule. This calculator immediately figures the balloon payment based on the gotten in funding amortization period. If you make interest-only settlements after that your month-to-month payments will be the interest-only payment quantity below with the balloon payment being the initial quantity obtained.

While banks and cooperative credit union provide business finances, not every person can access them. Standard commercial home loans impose rigorous underwriting procedures that take a very long time to obtain authorized (3 months or even more). They need high credit report as more helpful hints well as proof that your business has sufficient capital to pay back the home mortgage. hard money atlanta.

If you can't safeguard a typical commercial lending, you can transform to tough cash lending institutions. In this write-up, we'll speak concerning tough money funding requirements, its payment structure, and rates.

The Ultimate Guide To Hard Money Atlanta

What are Tough Money Loans? Unlike industrial financings from banks, hard cash finances are based on property being used as collateral instead than the debtor's credit reliability - hard money atlanta.This is frequently considered the last option if check my blog you are unqualified for standard commercial funding. Economic experts claim hard describes the nature of the finance, which is tough to fund by typical requirements. Nevertheless, others claim it refers to the security of the lending being a difficult property, which is the property residential property securing the finance.

This device numbers monthly payments on a tough cash lending, using settlement amounts for P&I, Interest-Only and Balloon payments in addition to offering a regular monthly amortization routine. This calculator automatically figures the balloon payment based upon the gotten in finance amortization duration. If you make interest-only settlements after that your monthly repayments will certainly be the interest-only payment amount below with the balloon payment being the initial quantity borrowed.

While banks and debt unions provide industrial fundings, not every person can access them. They need high debt scores and proof that your firm has enough money flow to pay off the home loan.

All about Hard Money Atlanta

If you can't secure a standard business loan, you can turn to difficult cash lending institutions. In this article, we'll speak concerning tough money funding needs, its payment framework, and also prices.

This is frequently thought about the last option if you are unqualified for typical business funding. Economists claim hard refers to the nature of the funding, which is tough to fund by conventional standards. However, others state it describes the security of the car loan being a tough possession, which is the realty building securing the lending.

Report this wiki page